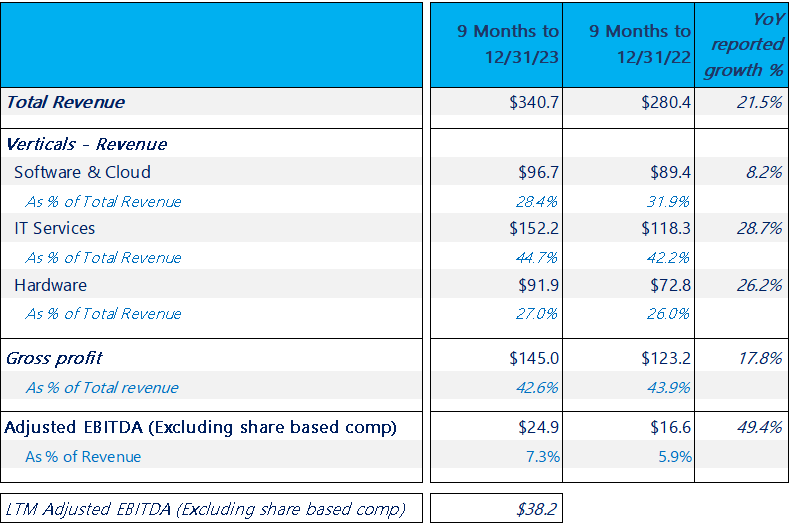

LONDON and PALO ALTO, Calif. – April 3, 2024 – Noventiq Holdings PLC (“Noventiq”), a global digital transformation and cybersecurity solutions and services provider, today announced unaudited key operating highlights for the nine Months ending 12/31/23 including revenues of $340.7 million, an increase of 21.5% in U.S. dollars, and Adjusted EBITDA (excluding share-based compensation) of $24.9 million, an increase of 49.4% in U.S. dollars.

Q3 YTD FY24 Business Highlights

- Noventiq delivered revenues for the nine Months ending 12/31/23 of $340.7 million, an increase of 21.5% year-over-year on a reported currency basis and 27.3% in constant currency.

- Gross profit for the nine Months ending 12/31/23 was $145.0 million, an increase of 17.8% year-over-year on a reported currency basis.

- Adjusted EBITDA (excluding share-based compensation) for the nine Months ending 12/31/23 was $24.9 million, an increase of 49.4% year-over-year on a reported currency basis. Adjusted EBITDA (excluding share-based compensation) margin on revenue was 7.3%, which represents a 140 basis point increase year-over-year.

- LTM ending 12/31/23 Adjusted EBITDA (excluding share-based compensation) was $38.2 million.

- Noventiq reported broad based strength for the nine Months ending 12/31/23 with double-digit growth in IT Services and Hardware, and high single-digit growth in Software & Cloud. Services revenues were $152.2 million, an increase of 28.7% year-over-year in reported currency. Hardware revenues were $91.9 million, an increase of 26.2% year-over-year in reported currency. Software & Cloud revenues were $96.7 million, an increase of 8.2% year-over-year in reported currency.

- The cash balance on 12/31/23 was $92.6 million, and net debt was a positive $6.3 million.

- Noventiq has also published an updated investor presentation which includes highlights of its strategy, positioning and financial results, which can be found at [Noventiq IR]

Hervé Tessler, CEO of Noventiq, said:

“I am very pleased with the momentum in our business, and the significant investments we have been making for future growth. Strategic acquisitions have been a core element of our long-term growth strategy, and during this year we have been particularly focused on capturing the full value of the acquired skills, capabilities and IP from the seven transactions we completed last year in FY23, and preparing the company for a Nasdaq listing. We are making good progress in driving expansion within existing and into new markets, bringing more depth and breadth of technology capabilities to help drive digital transformation for our customers.”

Refer to exhibits to this press release for reconciliations of Non-IFRS financial measures to IFRS financial measures.

$USD millions, except noted otherwise

Unaudited results

Investor Presentation

The updated investor presentation can be found here: [Noventiq IR]

Non-IFRS measures

This communication includes certain non-IFRS financial measures, such as Adjusted EBITDA excluding share-based compensation, recurring revenue, and growth in constant currency which are defined in the exhibits to this press release. These non-IFRS financial measures may not be comparable to similarly titled measures presented by other companies, nor should they be construed as an alternative to other financial measures determined in accordance with IFRS. We believe these additional metrics are meaningful indicators of financial and operational performance.

About Noventiq

Noventiq (Noventiq Holdings PLC) is a leading global solutions and services provider in digital transformation and cybersecurity, headquartered in London. The company enables, facilitates, and accelerates digital transformation for its customers’ businesses, connecting organizations across a comprehensive range of industries with best-in-class IT vendors, alongside its own services and proprietary solutions.

The company’s rapid growth is underpinned by its three-dimensional strategy to expand its market penetration, product portfolio, and sales channels. This is supported by an active approach to M&A, positioning Noventiq to capitalize on the industry’s ongoing consolidation. With around 6,400 employees globally, Noventiq operates in approximately 60 countries with significant growth potential in multiple regions including Latin America, EMEA, and APAC – with a notable presence in India.

Disclaimer

The financial information included in this communication comprises financial information derived from the unaudited financial statements for the nine months ended December 31, 2023. This communication includes certain non-IFRS financial measures, such as Adjusted EBITDA excluding share-based compensation, recurring revenue, and growth in constant currency which are defined in the exhibits to this press release. These non-IFRS financial measures may not be comparable to similarly titled measures presented by other companies, nor should they be construed as an alternative to other financial measures determined in accordance with IFRS. Certain figures contained in this communication, including financial information, have been subject to rounding adjustments (and, in certain circumstances, may not conform exactly to the total figure given).

Contacts

Steven Salter

Global Investor Relations VP

IR@noventiq.com

Rocio Herraiz

Global Head of Communications

pr@noventiq.com

Corner Growth Contacts

Investors:

Ryan Flanagan, ICR

ryan.flanagan@icrinc.com

Media:

Brian Ruby, ICR

Brian.ruby@icrinc.com

Exhibit 1 - Definitions.

“Constant currency revenue growth” or “revenue growth, CCY” is defined as the period-on-period growth of revenue calculated on a constant currency basis. To calculate revenue in constant currency, for every country of operations, we apply the prior period’s average exchange rate for that country’s functional currency to U.S. dollar to revenue in functional currency of the current year. This methodology is applied for every country of operations and then consolidated at the Group level.

“Constant currency gross profit” or “gross profit, CCY” is defined as gross profit calculated on a constant currency basis. To calculate gross profit in constant currency, for every country of operations, we apply the prior period’s average exchange rate for that country’s functional currency to U.S. dollar to gross profit in functional currency of the current period. This methodology is applied for every country of operations and then consolidated at the Group level.

“Constant currency gross profit growth” or “gross profit growth, CCY” is defined as period-on-period growth of constant currency gross profit.

“Adjusted EBITDA (excluding share-based compensation)” is defined as profit before interest, income tax expense, depreciation and amortization, foreign exchange gain, net financial income and expenses, property and equipment write-off, IPO-related bonus, employee termination write-offs and other items that we consider to be non-recurring or one-off (including penalties and acquisition related expenses).

“Adjusted EBITDA (excluding share-based compensation) growth” is defined as the period-on-period growth of Adjusted EBITDA (excluding share-based compensation).

“Adjusted EBITDA (excluding share based compensation) margin” is defined as Adjusted EBITDA (excluding share-based compensation) for the period divided by revenue for the period.

Exhibit 2 - Reconciliation of Non-IFRS financial measures to IFRS financial measures

|

|

|

|

|

|

Nine months ended December 31, |

|

|

(in thousands of U.S. dollars, unless otherwise indicated) |

2023 |

2022 |

|

|

|

|

|

Revenue |

340,744 |

280,389 |

|

Add/(Less): |

|

|

|

Belarusian ruble impact |

11,046 |

538 |

|

Indian rupee impact |

3,230 |

2,517 |

|

Argentine peso impact |

1,979 |

1,340 |

|

Egyptian pound impact |

1,839 |

1,052 |

|

Argentine peso impact |

|

|

|

Turkish lira impact |

1,727 |

2,407 |

|

Euro impact |

-1,127 |

3,196 |

|

Kazakh tenge impact |

-255 |

1,511 |

|

Other |

-2,354 |

2,269 |

|

Revenue, CCY |

356,829 |

295,219 |

|

Revenue growth, CCY |

27.3% |

— |

|

|

|

|

|

|

Nine months ended December 31, |

|

|

(in millions of U.S. dollars) |

2023 |

2022 |

|

|

|

|

|

Loss for the period from continuing operations |

-30.0 |

-25.7 |

|

Added back: |

|

|

|

Income tax expense |

7.2 |

0.3 |

|

Depreciation and amortization |

16.3 |

11.5 |

|

Foreign exchange (gain) / loss |

7.7 |

7.8 |

|

Net financial income and expenses |

9.3 |

11.5 |

|

Property and equipment write-off |

0.0 |

0.1 |

|

Employee termination payments |

1.1 |

1.2 |

|

Impairment losses |

6.1 |

6.3 |

|

One-off items (penalties and acquisition related expenses) |

7.2 |

4.1 |

|

Adjusted EBITDA (excluding share based compensation) |

24.9 |

17.1 |